Clients Satisfaction

GST Identification number or GSTIN is a 15-character unique number provided by Government to every registered taxpayer. Only the holders of valid GSTIN are allowed to charge and collect GST on the supplies.

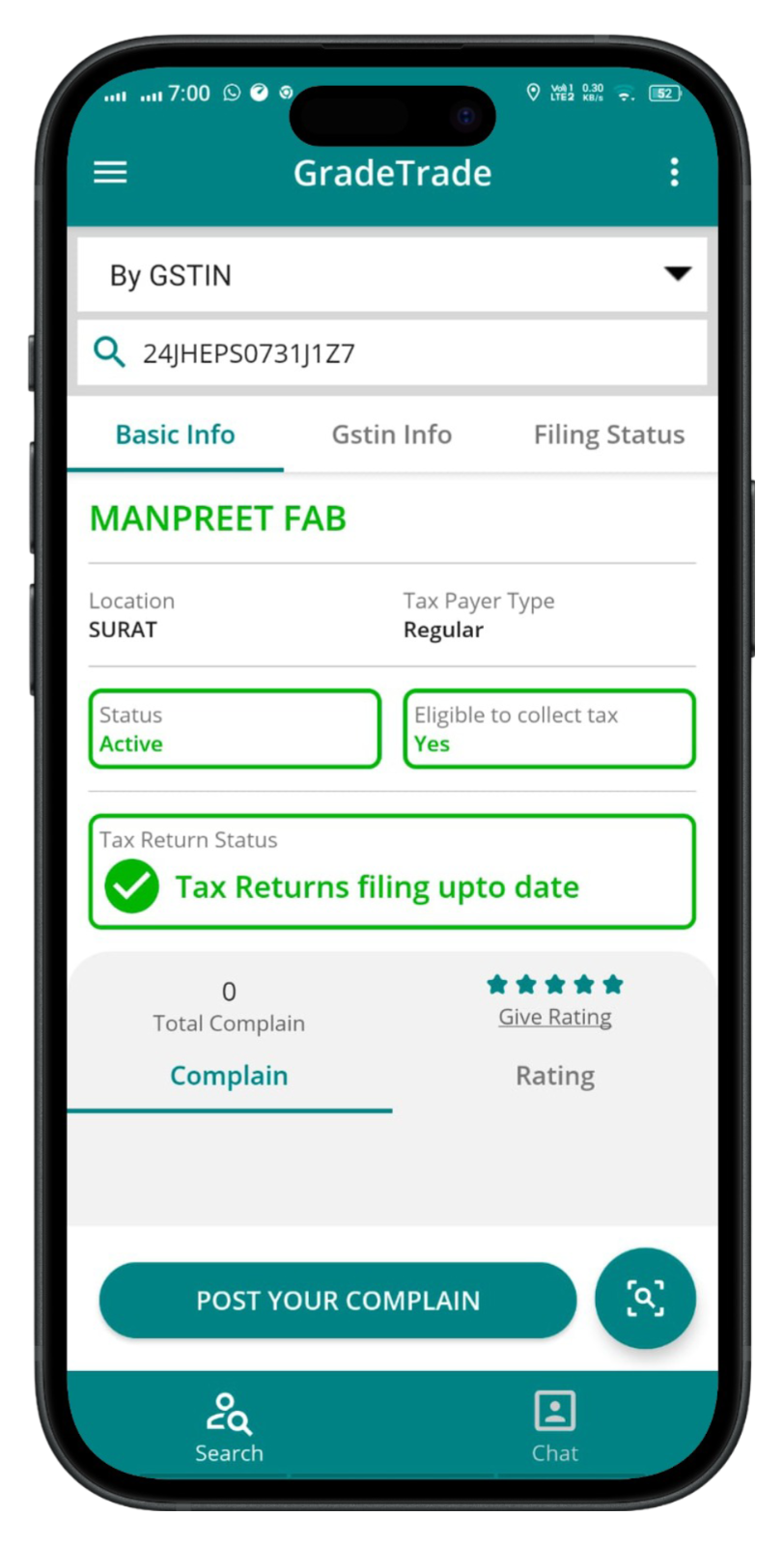

GradeTrade is a user-friendly app designed to help businesses.

GradeTrade is more than just an app. It is a searchable data repository and available via APIs and is designed to take in plug-in additional data sets in future.

GradeTrade is a handy and easy to use app which helps you to verify the correctness of a GSTIN by validating it with GST system , connected Business at one place and you can chat with the same Business Field through the request and review. For valid GSTINs, the status of returns filed can also be viewed in the app.

GST Identification number or GSTIN is a 15-character unique number provided by Government to every registered taxpayer. Only the holders of valid GSTIN are allowed to charge and collect GST on the supplies.

GradeTrade is more than just an app. It is a searchable data repository and available via APIs and is designed to take in plug-in additional data sets in future.

In this feature you can search any gst detail by PAN Number. Enter the PAN Number in the text box an...

Scan document feature allow you to find GST detail from scanning the GSTIN, NO need to type a single...

In this feature you can file the complain againts the froud bussiness who are not follow the market...

This feature provides you to give rating to the bussiness according their service and behaviour.By u...

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

GST Identification number or GSTIN is a 15-character unique number provided by Government to every registered tax payer.

Only the holders of valid GSTIN are allowed to charge and collect GST on the supplies. Businesses without a valid GST number cannot charge GST.

It is necessary that the taxpayers mention their GSTIN on the invoices prepared by them. Further, the GSTIN number needs to be mentioned on the sign boards in their premises.

GSTIN also has an important role in the GST return filing as it identifies the registered business thus can help ensure a genuine of B2B transaction. The correctness of your counter-party’s GSTINs has a direct impact on your ITC claim. Thus GSTIN verification is a must.

Please fill contact form and we will be happy to assist you.